It is really expensive to get a degree in the USA. Every student seeks the best student loan option to pay for their education. The institutions that fund education for students provided that they will be paid off later are called student loan providers.

About 43 million consumers had federal student loan debt in the USA in 2019. In this article, we are going to talk about the ways to find the best student loan and how student loan interest works.

Ways to Obtain a Student Loan

Families should complete the Free Application for Federal Student Aid (FAFSA) to qualify for different forms of aid for federal students.

This form gathers student asset and income data as well as the assets and income of their parents in case the young person is a dependent. This information is used for calculations called the Expected Family Contribution (EFC).

The EFC is needed to define what types (loans and grants) and the sum of assistance for federal students will the individual be eligible for. Prior year income tax details are collected by the FAFSA.

Later, this application defines if an individual qualifies for federal student loan assistance. Some institutions use the CSS Profile. It is needed to calculate a student’s non-federal student financial aid. Besides, you need to pay money to complete the CSS Profile every year.

The National Center for Education Statistics claims that it costs on average $20,598 to attend a college for four years while private for-profit and nonprofit institutions are even more expensive.

It includes undergraduate fees, room, tuition, and board. As the vast majority of households don’t have this sum saved to pay each year straight away, they rely on student loans as an option that allows them to cover the costs of their education.

Types of Student Loans

Students have a few options to choose from when it comes to student loans depending on their degree program:

- Federal undergraduate loans: American citizens and residents may qualify for federal student loans. If your credit rating is less-than-stellar you may need to turn to top credit repair companies. However, consumers with any credit score may still apply for federal student loans. You have the option of Direct Subsidized Loans or Direct Unsubsidized Loans.

- Federal graduate loans. Graduate students may obtain Direct PLUS Loans or Direct Unsubsidized Loans. The second option is cheaper while Direct PLUS Loans offer higher sums.

- Student loan refinancing. Those who have already taken out student loans before but want to change the interest rate or repayment term may need to refinance. This option helps you to get rid of your old loans in exchange for a new loan.

- Private undergraduate loans. Students who have taken out the maximum in the form of federal loans can also obtain a private student loan. Many international students opt for this solution if they plan to study in the USA.

- Private graduate loans. Students who attend business schools, law schools, medical schools, and other institutions may choose private loans for graduate study.

Student Loan Interest Information

The sum you borrow in the form of a student loan isn’t the only sum you need to repay. Interest adds significantly to the total cost of the loan.

When you apply for a federal student loan, an interest rate will be offered. This is an additional percentage of the loan sum you will need to pay every month.

The federal government determines the interest rate for all students every year. This interest is the same for all applicants. The interest rate of a private loan is defined by the credit rating of the borrowers as well as their income and other factors.

Students with better financial health and excellent credit score get approved for the most reasonable private student loans.

Potential borrowers may typically select between a fixed and a variable interest rate. The variable interest changes based on market trends while the fixed rate remains the same during the whole repayment period.

Federal student loans always have fixed interest rates, but private student loans may come with fixed or variable rates.

How to Choose the Right Student Loan Provider

There are some differences between federal and private student loan providers you need to consider when you are willing to choose the right provider. The Department of Education guarantees federal student loans.

You may be offered two types of federal loans: unsubsidized and subsidized. The type and the sum are based on the applicant’s grade level and financial need.

A student loan servicer will be assigned to each borrower. The interest rates offered by the federal government are fixed.

A private student loan is offered through a financial company, institution, or state agency. Each company defines its interest rates and other fees. The variable interest may change significantly throughout the life of the loan.

Experts recommend students do some research and compare the rates of several providers before they make their decision. Besides, they may need to find a cosigner to obtain private student loans.

Federal student loans offer more benefits including forgiveness options. According to the Federal Student Aid, an office of the U.S. Department of Education, you may have your federal student loans forgiven, discharged, or canceled in certain situations.

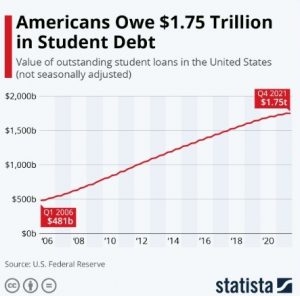

The following statistic indicates how the amount of student debt has increased over the past decade, which is one of the reasons why demands for student debt relief have become louder and more common.

Federal Pell Grant recipients can be eligible for up to $20,000 in debt relief, and other federal student loan borrowers can obtain up to $10,000 in debt relief. Forgiveness, discharge, or cancellation of your loan means that you are no longer required to pay off some or your entire loan.

The Bottom Line

If you are willing to get a degree, you may need to take out a student loan. You may qualify for federal student loans offered by the federal government or private student loans offered by various financial institutions.

Take some time to review your options and interest rates before you request a loan. A common misunderstanding is that students whose parents earn a lot of money can’t qualify for financial aid.

In reality, your parents’ income won’t prevent you from qualifying for federal student loans as there are various options. Do as much homework as you can and compare different options.

Make everything possible to have funding available to pay for your college or university. Remember that it will be your responsibility though to repay the debt over time together with the interest.

See more page for more information